Beyond Brand Awareness

How Smaller Banks Win Consumer Consideration

Brand recognition is just the beginning. Rivel Banking Research reveals how smaller, regional financial institutions are outperforming national competitors—not with bigger budgets, but with greater trust, relevance, and clarity.

From Familiar to Considered

Being recognized doesn't mean being chosen. In today's market, success hinges on transforming awareness into genuine consumer consideration. Smaller financial institutions are doing just that—winning new customers by building stronger reputations in trust, service, and community alignment.

Smaller, regional financial institutions can outperform national competitors despite smaller marketing budgets.

Our research shows that despite smaller marketing budgets, regional institutions are outperforming national competitors by building trust, delivering standout service, and establishing a clear identity that resonates within their communities.

-

Trust & Service

Consumers prioritize institutions they believe in,not just those they've heard of.

-

Clear Identity

Banks need more than recognition; they need a standout position in the market.

-

Local Advantage

Personalized service and community involvement resonate deeper than national ads.

-

Consumer Perception

Awareness without credibility leads to stagnation in consideration.

-

Strategic Focus

Smaller institutions win by concentrating efforts where it matters most—locally.

Rivel's benchmarking survey results have helped drive a lot of our marketing messages, both internally and externally, and will continue to do so for years to come.

Consumers prioritize personal connection, community involvement, and authenticity over sheer size and scale.

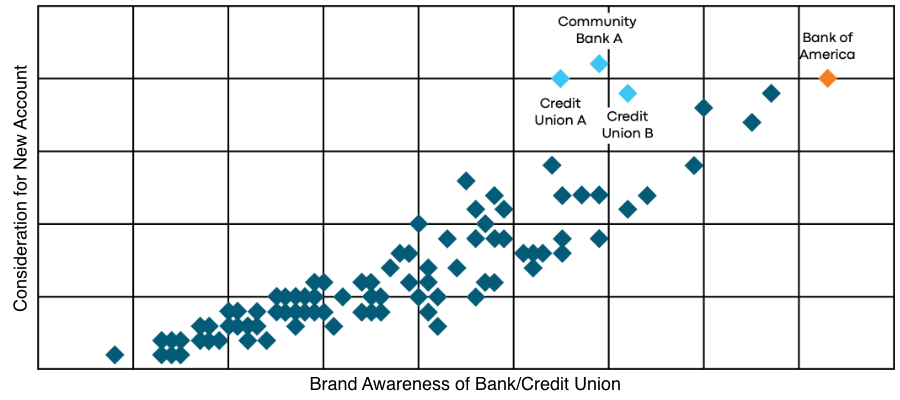

Our research revealed three Massachusetts-based banks that are making strong strides—even with fewer than 25 branches and under $10 billion in assets. Their success is tied to strong local brand awareness and reputations built through community connection.

In contrast, larger institutions like Bank of America are recognized but often lack the personal connection consumers seek. Smaller banks outperform them in trust and service—two key drivers of consideration.

Download Full Report (PDF)Research Report

Three community institutions outpacing their national peers on consideration

Beyond Brand Awareness - Rivel, Q1 2025

Consumers seek more than just familiarity—they seek value, trust, and relevance.

The key advantage of smaller regional banks

Smaller banks don't need to compete on a national scale—they win by focusing on what matters locally. Instead of stretching budgets thin, they invest in deeper relationships through community events, sponsorships, and personalized service.

This targeted approach resonates more with potential customers than generic advertising, helping to define a bank's unique value compared to its larger peers.

Download the Full Report: Beyond Brand Awareness (PDF)Awareness isn't enough:

A cautionary tale from Atlanta

Despite a 67% increase in brand awareness over three years, one Atlanta-based community bank remains flat in consumer consideration. Why? They haven't differentiated themselves in the eyes of local consumers.

Perception scores remain average or below across key factors, such as technology, community impact, and convenience, making the institution seem interchangeable with other local options.

If I've heard bad things about them, I'm unlikely to bank with [a local option] despite the good rates. If I've not heard anything bad about them, I'm willing to look into their products and advertised rates more.

Reputation for an Atlanta community bank

Seen here as ABC Bank, Rivel, Q3 2024

| ABC Bank Score |

Market Norm Score |

Rivel Health Score |

|

|---|---|---|---|

| Good Customer Service | 56 | 56 | B |

| Trustworthy | 58 | 58 | B |

| Attractive Deposit Rates | 43 | 48 | C |

| Strong Institutional Reputation | 51 | 57 | C |

| Strong Community Contribution | 40 | 47 | C |

| Good Technology | 47 | 56 | C |

| Convenient Locations | 32 | 47 | D |

All perception scores graded on a 0-100 scale among non-customers, relative to local peers.

Differentiation is the key to turning awareness into action. Without it, you risk being overlooked by the very consumers you aim to attract.

How Rivel helps banks earn consideration

Measure

Understand how the institution is perceived on key factors like trust, service, reputation, and local relevance—compared to competitors in the market.

Compare

Benchmark perception scores against peer institutions to identify strengths and uncover gaps that may be holding back consideration.

Act

Transform insights into action. Use findings to improve messaging, support staff training, and strengthen local positioning.