GuideLign

Unrivaled Strategic Research

A management intelligence tool relied on by thousands of corporate executives to guide strategic decisions related to the investment community.

Advisory

Direct access to Rivel's senior-level investor relations executives (with 20+ years of experience) to proactively and reactively help members work through questions, issues and opportunities.

Research

Continuously updating our library of research from the corporate and investment community perspectives.

Concierge

Dedicated and knowledgeable team focused on getting you the answers you need when you need them.

Community

Connecting you with your peers through our vendor-free conferences, Rapid Action surveys and Virtual Exchange meetings.

"Data without action is useless. Action without data is dangerous."

In-Depth Impactful Research

By understanding what the investment community wants and expects, your executives can respond in research-guided ways that positively impact your valuation. GuideLign eliminates guesswork and provides certainty, allowing you to make better decisions in a shorter time frame.

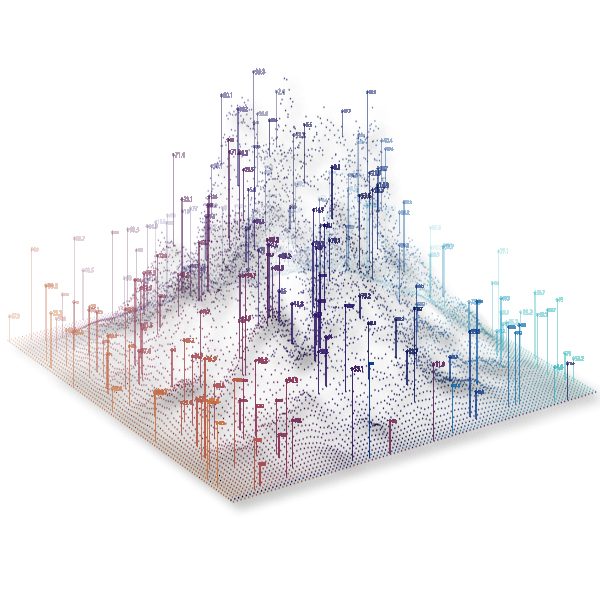

The Methodology Is the Difference

Our ability to quantify anecdotal feedback is unrivaled. This methodology allows us to report insight that is representative of the perspectives of each audience we survey. The GuideLign investment community and corporate research is based on feedback we elicit from large global samples (with some reaching as high as 900).

Best Practices

Our investment community research enables you to identify what these professionals want from an IR function on topics A-Z. Our corporate research is informative on what other IR departments are doing about those same topics.

Understanding the perspectives of both audiences allows you to bridge the gap as a best-in-class IR program.

The Value of GuideLign

Advisory

- On-call consultation with Rivel’s senior-level investor relations executives

- Expert take on particular issues or topics important to your company

- Small, focused virtual roundtables to work through a particular issue

- Delivery of advice to your management team and board on investment community needs

Research

- Investment community

- Corporate community

- Benchmarking

Community

- Annual 2-day conference

- Virtual exchange meetings

- Member introductions

Concierge

- Extension of your team

- Our research library

- Rapid action surveys